How does El Niño impact the blue economy ?

The El Niño weather phenomenon is officially back, as confirmed by the World Meteorological Organization (WMO) last July. El Niño appears every two to seven years for a period of 9 to 12 months, disrupting the agricultural and fishing sectors. Zoom in on this phenomenon and its impact on the blue economy.

What is “El Niño”?

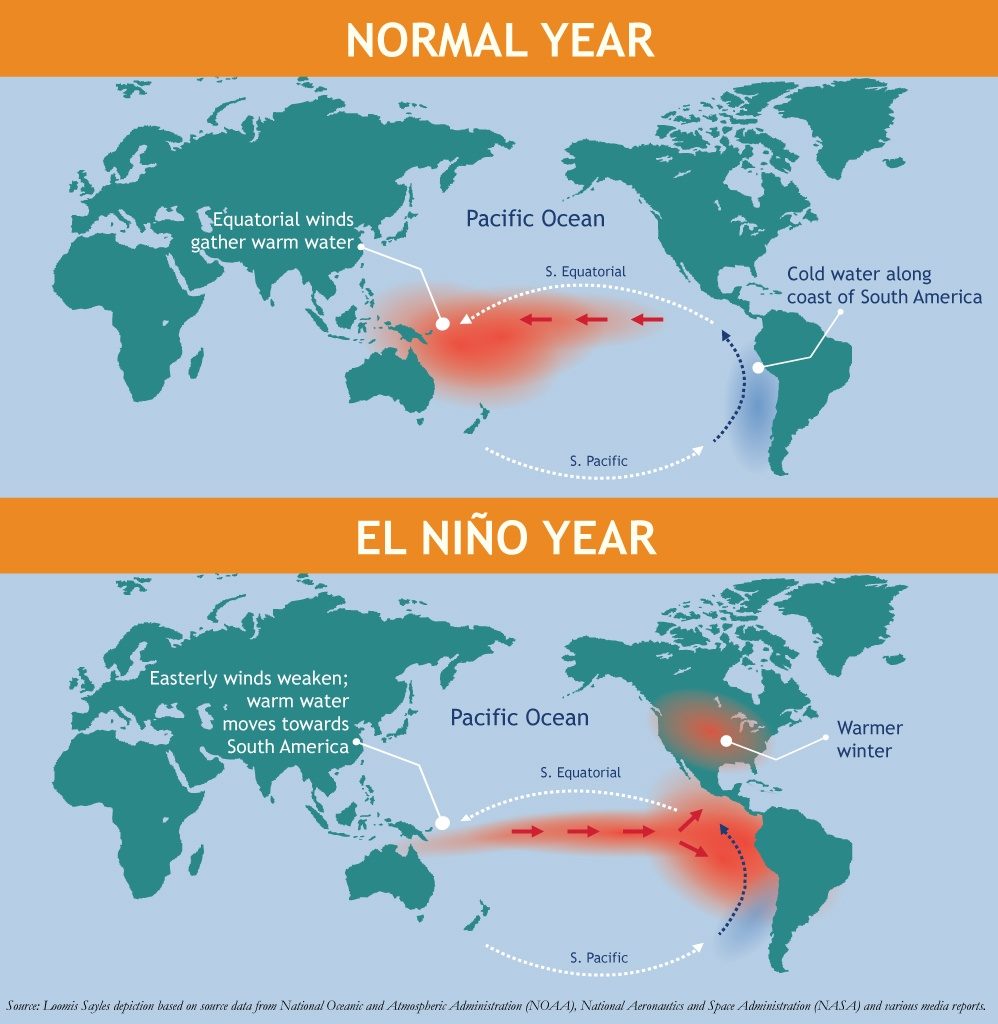

According to Météo France, El Niño, which means the Child (Jesus), was originally, for Peruvian fishermen, a phenomenon occurring every year around Christmas and resulting in a warm marine current off the coasts of Peru and Ecuador, putting an end to the fishing season. The term was later used to designate “anomalous” cases where this current becomes warmer, descends further south to off the coast of Chile, and also corresponds to temperature anomalies throughout the eastern and central basin of the equatorial Pacific.

El Niño weather conditions generally lead to heavy rainfall and even flooding in South America, an increase in the number of cyclones in the Pacific and severe drought in Australia and South Asia. The phenomenon reaches its peak between November and January.

How does El Niño affect marine resources ?

As reported in Espace Sciences, the Southern Oscillation is causing an upheaval in hydrological conditions in the tropical Pacific, the consequences of which on marine resources are still poorly understood. They affect not only the biology of fish populations (reproduction, survival of eggs and larvae), but also their geographical distribution (extent and movement) and bathymetry (depth of water masses frequented).

Under normal conditions, a phenomenon known as “upwelling” brings fresh, nutrient-rich water up from the depths of the ocean. This phenomenon is particularly important for the development of anchovy stocks, which can exceed 15 million tonnes off the coast of Peru. Anchovies need cold coastal waters to thrive. When El Niño occurs, this upwelling process is interrupted. The anchovy population can only survive if it finds a safe haven, otherwise it disappears.

Warm waters along the coast also limit phytoplankton, reducing the amount of food available to certain fish, forcing them to move to areas richer in planktonic prey (up to 2,500 km for tropical tunas, for example).

Anchovy shortage in 2023

El Niño conditions led to the cancellation of Peru’s first fishing campaign (April-May), as successive exploratory fisheries revealed an excessive presence of juveniles, i.e. young anchovies under 12 cm.

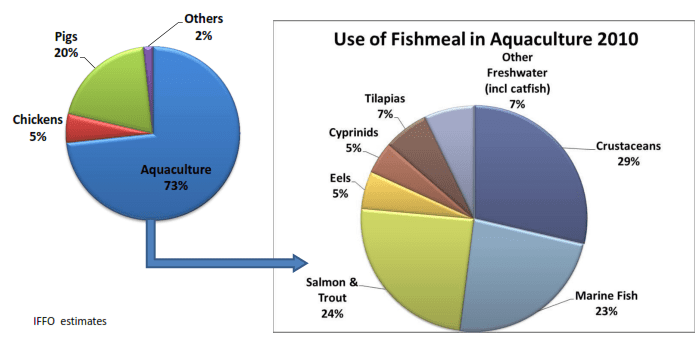

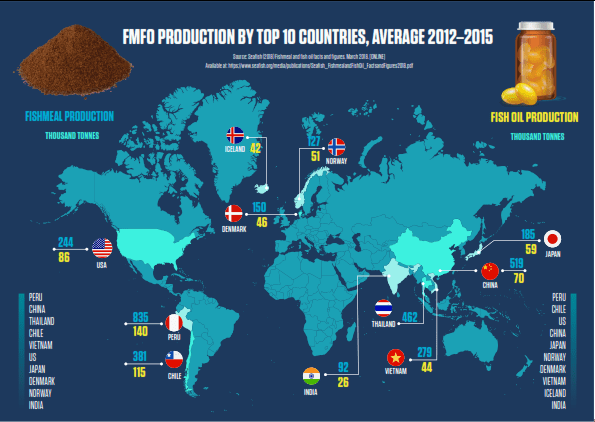

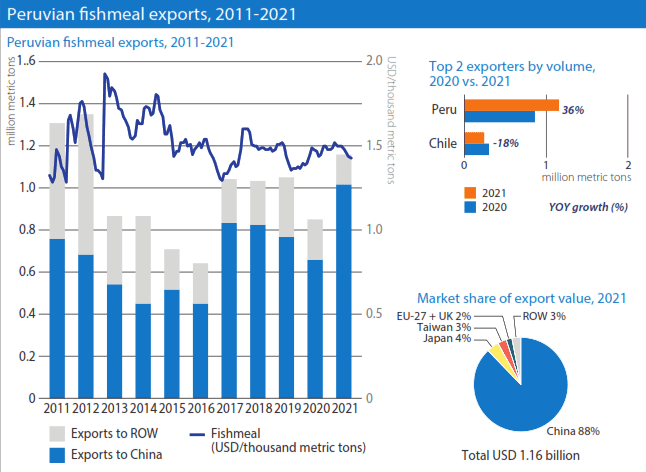

In the absence of the first 2023 fishing season, Peruvian anchovy production will be lower than last year’s 2.8 million tonnes. Almost all of these anchovies are processed into omega-3-rich oil and meal for fish and animal farms, a global sector that is 20% dependent on Peru.

Impact on fishmeal and fish oil markets

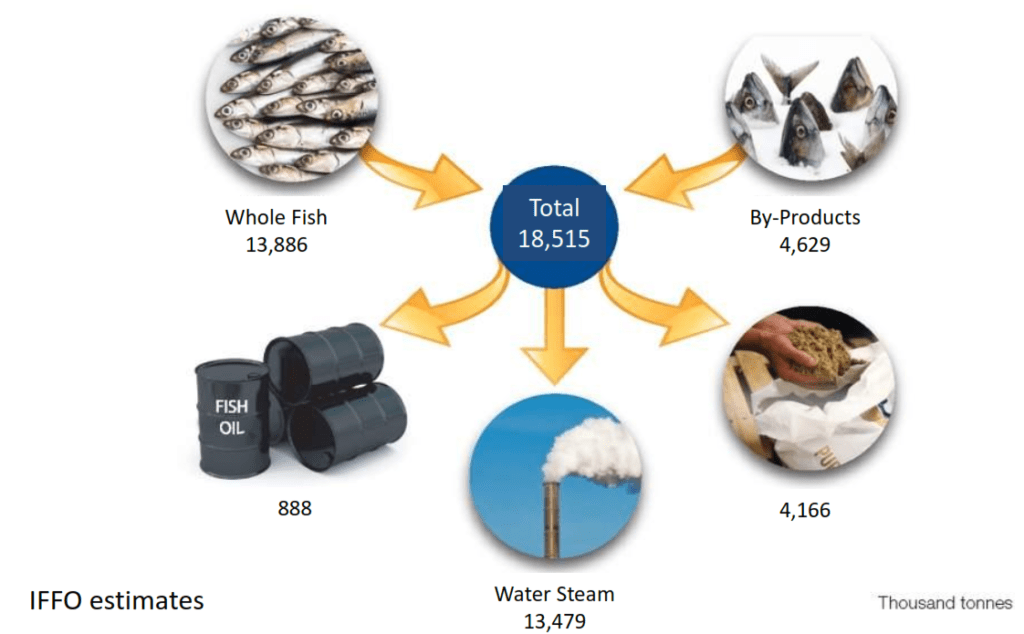

Total cumulative fishmeal production in the first eight months of 2023 has fallen by around 28% compared with cumulative production reported up to August 2022, the IFFO (Fishmeal and Fish Oil Organization) has reported. The predominant factor contributing to this decline must be attributed to the 70% year-on-year decrease in Peru. As for fish oil, total cumulative production in the first 8 months of 2023 was down 24% year-on-year, according to IFFO.

Due to this shortage of fishmeal and fish oil, aquafeed prices are expected to remain high until the end of the year.

This year, the supply of fishmeal will fall by over 500,000 tonnes , and the price of Peruvian fishmeal, currently $2,000 per tonne, is set to rise soon, according to Mr. Nikolik, senior global seafood specialist at Rabobank. Fish oil prices are soaring: $5500 per tonne in the first half of 2023, compared with $1800 in the first half of 2021.

A difficult second half of 2023 for aquaculture

With El Niño pushing up fishmeal prices, the second half of 2023 is set to be the most difficult period for global aquaculture since the peak of the Covid pandemic in 2020, according to Rabobank. These difficulties particularly affect Chinese aquaculture, which sources 50% of its fishmeal from the South American market.

The Rabobank analyst also tells Fish Farming Expert that Peruvian fishmeal and fish oil are certified for sustainability. “Buyers looking for alternatives won’t be able to find them, which will have an impact on the sustainability commitments of the entire aquaculture value chain.”

What’s the outlook for the sector ?

We can refer to previous years, in particular 2014, a very marked El Nino year.

“What happened next is interesting. Between 30% and 60% of Peruvian anchovy biomass is harvested in most years. In 2014, this translated into a very high biomass in the following season and a quota of 2.5 million tonnes, 97% of which was harvested. A similar situation is expected this time around,” explains Mr. Nikolik.

However, warns Arnaud Bertrand, researcher at the IRD (Institut de recherche pour le développement), in the medium to long term, the industry must prepare for the “end of the Peruvian anchovy Eldorado”, which predicts a collapse in the anchovy population off Peru, under the pressure of climate change.

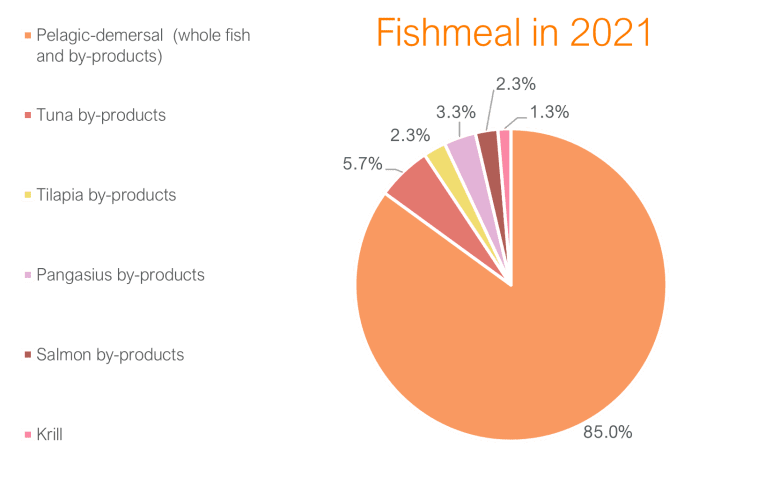

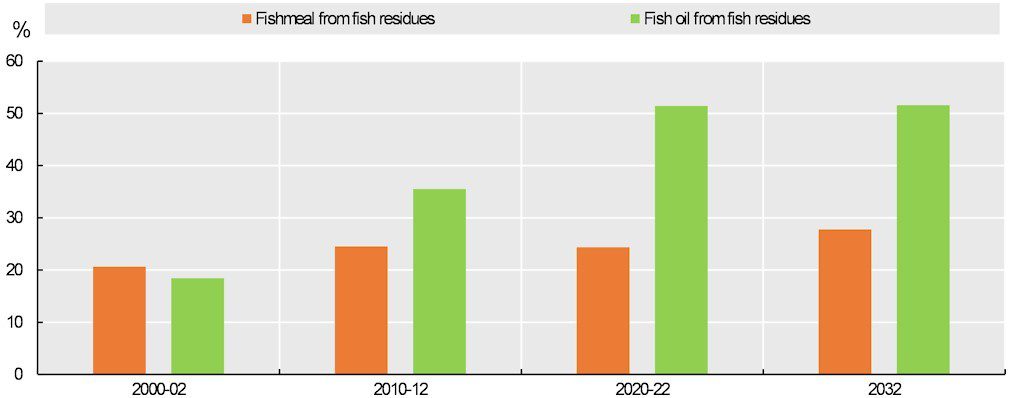

This scarcity of resources should encourage the use of fishing residues and by-products in the production of fishmeal and fish oil, and give a boost to companies developing alternative ingredients for aquaculture, such as insect meal, single-cell proteins or algae oils.

The Organisation for Economic Co-operation and Development (OECD) and the Food and Agricultural Organization (FAO) forecast that by 2032, world production of fishmeal and fish oil could reach 5.4 Mt and 1.3 Mt respectively (by product weight), corresponding to growth of 4.0% and 11% compared to the reference period. Due to their high price, fishmeal and fish oil should be used selectively at specific stages of production, notably for hatcheries, broodstock and finishing diets, as they are considered the most nutritious and digestible ingredients for farmed fish.

Figure: Share of fishmeal and fish oil obtained from fish residues (source: OECD/FAO (2023), ”OECD-FAO Agricultural Outlook”)

Upcyclink, the marine by-products recovery solution

In this context, Upcyclink gives industry professionals a head start in terms of value creation and resilience.

As an expert in the recovery of marine by-products, Upcyclink offers turnkey solutions to processors for the recovery of marine by-products, and facilitates their access to the aquafeed and peetfood markets via downstream resale. Upcyclink’s full recovery of by-products anticipates the scarcity of resources by extracting the best added value (food, feed, petfood,…) from 100% of the biomass.

Upcyclink also meets the needs of buyers, with qualified alternative products in terms of sustainability, quality, purity and traceability.